Business

Business Banking Solutions to Launch 2026 with Confidence

2026-01-09

A new year is more than just a fresh start. It’s an opportunity to reset your finan

Personal

Smart Money Moves to Kick Off 2026

2026-01-09

A new year brings a fresh opportunity to reset, refocus, and make thoughtful decis

FNWM

FNWM 25Q4 Market Update

2026-01-06

Winter’s Chill, Spring’s Promise 2025 in Review and Macroeconomic Themes to Watch in

Security

Don't Let Fraud Steal Your Holidays

2025-11-18

The holiday season is a time for joy and celebration, but it also brings an increas

Personal

Phasing Out the Penny

2025-11-18

Understanding the Penny Phase-Out You may have heard the news: the U.S. government

FNWM

FNWM Q3 Market Update

2025-10-08

A fall hello from First National Wealth Management! As harvest season arrives and

Personal

Cozy Up Your Home This Fall

2025-10-06

Make Your Home Ready for FallAs the seasons change in Maine, so do the needs of you

FNB Community

First National Bank Announces Winners of the Annual Customer Photo 2026 Calendar Contest

2025-07-18

First National Bank is proud to announce the winners of its eighteenth annual Custo

Security

Recognize Check Fraud Red Flags

2025-07-17

In today's digital age, it's more important than ever to be vigilant against variou

FNWM

FNWM Q2 2025 Market Update

2025-07-09

Resilience Amid Risk: Markets Rebound Despite Global HeadwindsThe second quarter of

Personal

Make Banking Easy, Wherever Summer Takes You

2025-06-20

Summer's approach means more outdoor adventures and less time at your desk. Keep yo

.jpg)

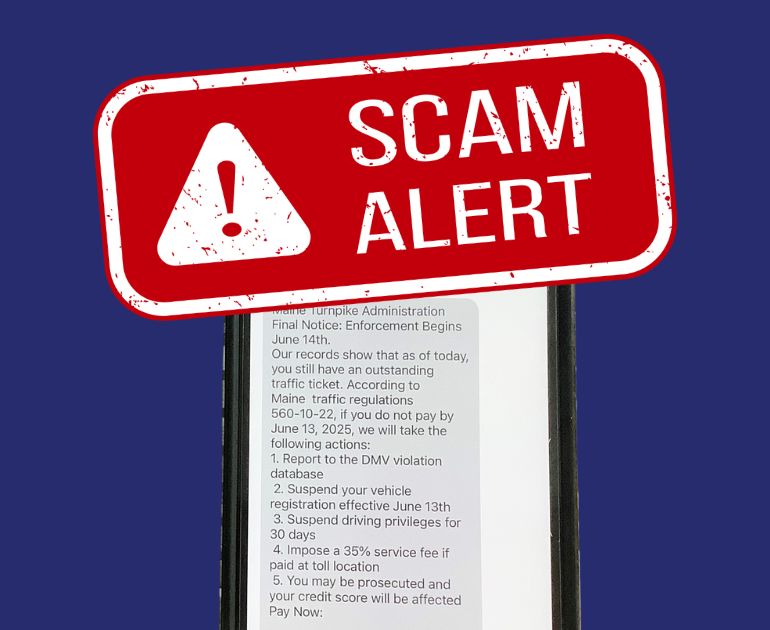

Security

Nationwide DMV Scams Targeting Consumers

2025-06-18

There has been a rise in a text messaging scam that is targeting people across the U

FNB Community

Empowering Future Innovators: First National Bank’s $15,000 Boost to Hurricane Island’s STEM Programs

2025-06-18

First National Bank recently announced a $15,000 contribution to Hurricane Island C

FNB Community

Building a Stronger Community: First National Bank Supports MRC with $50,000 Contribution

2025-05-20

First National Bank recently announced a $50,000 contribution to the Midcoast Recre

Security

Beware Job Offer Scams

2025-05-09

Have you received a random text message out of the blue offering you an exciting jo

FNB Community

Making a Difference: First National Bank Steps Up with Donations to Local Food Pantries

2025-05-04

First National Bank recently announced that it has made donations totaling $38,250

FNWM

FNWM Q1 2025 Market Update

2025-04-04

The first quarter of 2025 has seen mixed performance across global markets, with the

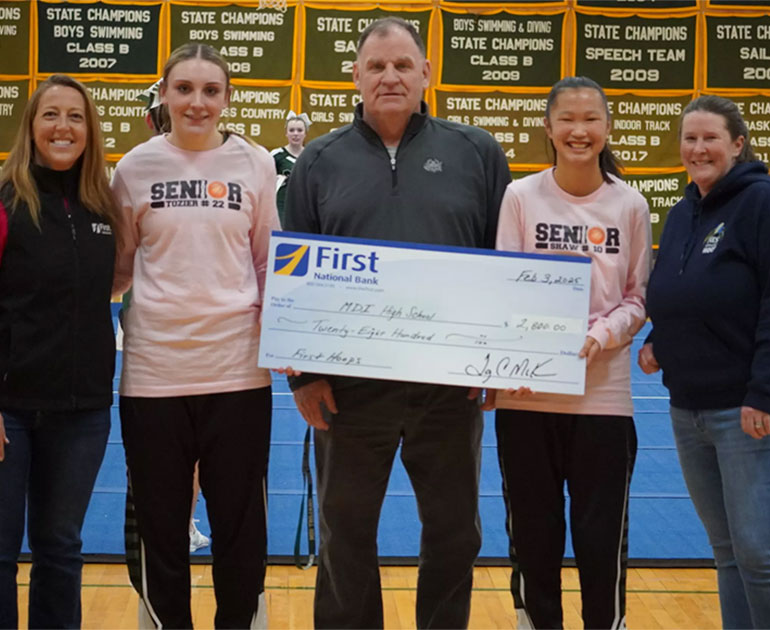

FNB Community

Two Decades Strong: First Hoop Donates $40,350 in Landmark Year

2025-03-10

As the Maine high school basketball season has come to a close, First National Bank

FNWM

Markets Are Volatile - What Should You Do with Your Portfolio?

2025-03-07

With recent market fluctuations and economic uncertainty, staying focused on long-t

Business

Elevate Your Restaurant with Clover Solutions

2025-01-15

Presented by the First National Bank Digital Commerce team, Clover Restaurant Solu

Business

Transform Your Hospitality Operations with Skyware Systems

2025-01-15

First National Bank’s partnership with Skyware Hospitality Solutions brings you a

FNWM

Our Commitment to Client Relationships

2025-01-15

At First National Wealth Management, our focus on exceptional client relationships

FNWM

Demystifying the Role of a Trust

2025-01-15

Demystifying trusts is essential for effective estate planning, as Laura Comer, Rel

Security

Data Breach Tips

2025-01-15

What to do if your data is compromised Banks are national leaders in preserving the

.png)

Security

Protect Yourself Against Text Scams

2025-01-14

As we see an uptick in text scams sent to our customers, keep these safety tips in

Security

Can you recognize a scam?

2025-01-14

Cybersecurity is critical and we want to help you protect your accounts and persona

Personal

Your 2025 Financial Game Plan Starts Here

2025-01-14

As we step into 2025, it’s the perfect time to take a fresh look at your financial

FNWM

FNWM Q4 2024 Market Update

2025-01-14

Happy New Year from all of us at First National Wealth Management! As the final qu

Business

5 Smart Financial Moves to Help Your Business Grow in 2025

2025-01-13

Take Your Business to the Next Level with First National Bank At First National B

Personal

Is Now the Time to Buy or Refinance

2024-12-19

Home Inventories are up and mortgage rates are lower The Maine housing market is sh

Security

Help Your Loved Ones Avoid Scams

2024-12-18

Have you ever received emails, phone calls, texts or even letters in the mail inform

FNB Community

Winners of the 2024 Photo Calendar Contest

2024-12-04

DAMARISCOTTA – First National Bank is proud to announce the winners of its sixteent

FNB Community

First National Bank supports Maine’s Lobster Industry with $300k donation

2022-11-07

First National Bank (FNB) announced a $300,000 commitment to the Maine Lobstermen’s